Taking stock of the supply chain crisis: Lockdowns and shortages cost automotive manufacturers over $500 billion

Supply chain issues and semiconductor shortages have been all over the news in the past two years, with many automotive manufacturers announcing line stoppages and losses in revenue as a result. But just how serious did things get? What has been the impact of the shortages so far?

To find out, Avnet Silica analysed the public financial records for the major semiconductor and automotive manufacturers to reveal how low semiconductor stock levels dropped during the COVID-19 pandemic, and the effect this has had on the automotive production lines and revenue.

Key findings:

- Auto manufacturers lost out on nearly $300 billion in revenue in 2021 during supply chain shortages, and over $500 billion since the start of the pandemic

- 70% of major global auto manufacturers have announced line stoppages in the last year, with 45% of them specifically citing supply chain issues

- Semiconductor stock levels dropped 43% in 2 years to reach the lowest point in over a decade

- While chip manufacturers dropped to just 23 days of finished stock, lead times rose to over 150 days, with some chip manufacturers dropping as low as 3 days of stock

- There are some early signs of supply chain issues easing with semiconductor stock levels rising but there’s still some way to go

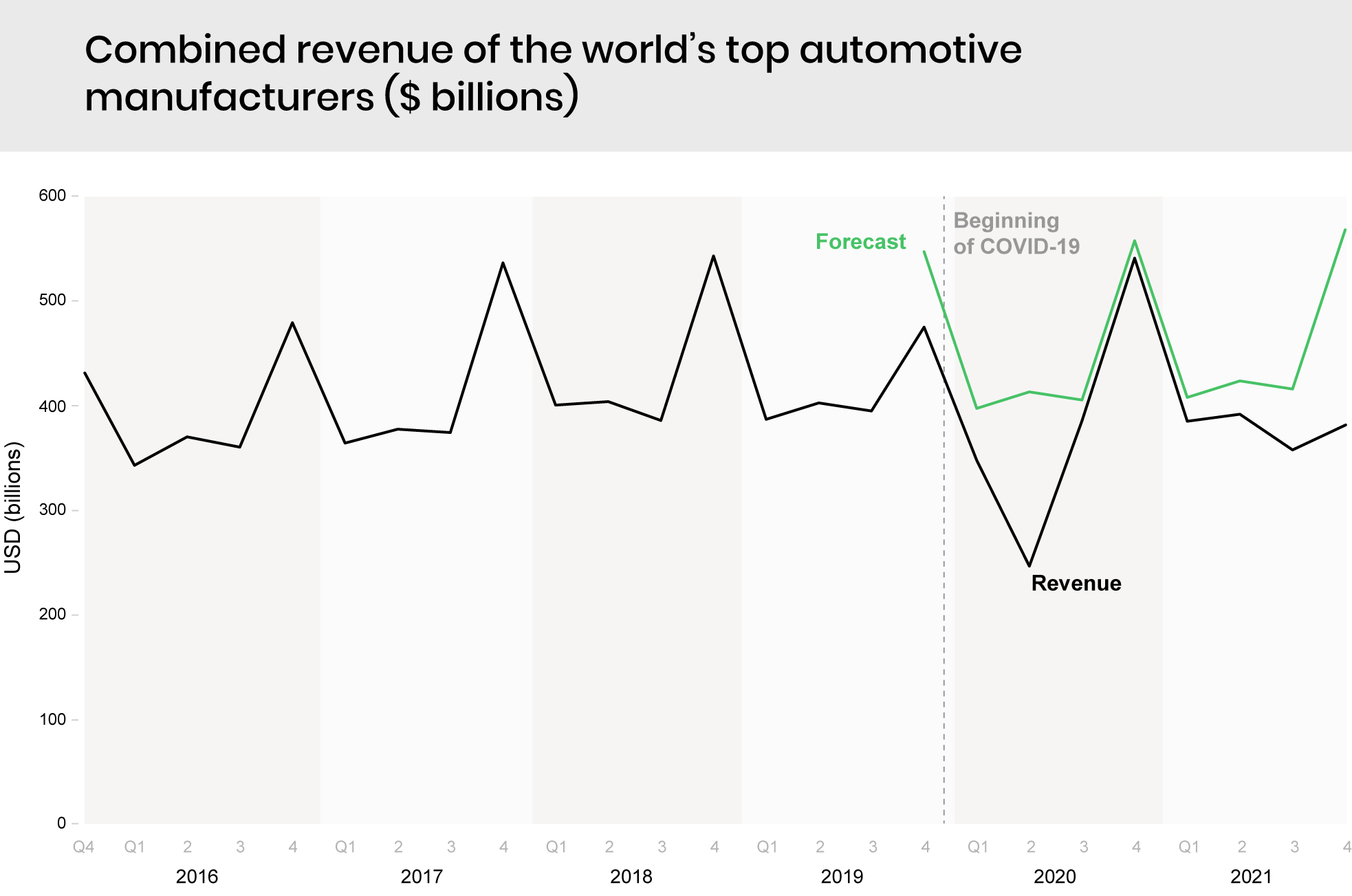

Automotive manufacturers lost out on over half a trillion dollars in the past 2 years

During the first wave of COVID-19 lockdowns, car manufacturers lost over $166 billion in sales in Q2 2020 due to a massive drop in consumer demand. Customers then returned in the next 2 quarters, but in every quarter of 2021, supply chain shortages prevented automakers meeting demand.

As a consequence, car manufacturers lost out on over $300 billion in revenue in 2021, and Q4 was the worst quarter in the last decade, with car makers losing out on over $186 billion in sales, compared to pre-pandemic forecasts.

Previously reported estimates put the losses in 2021 at $210 billion, but analysis of automakers’ financial reports reveals the actual loss in sales was almost 50% higher, at over $300 billion.

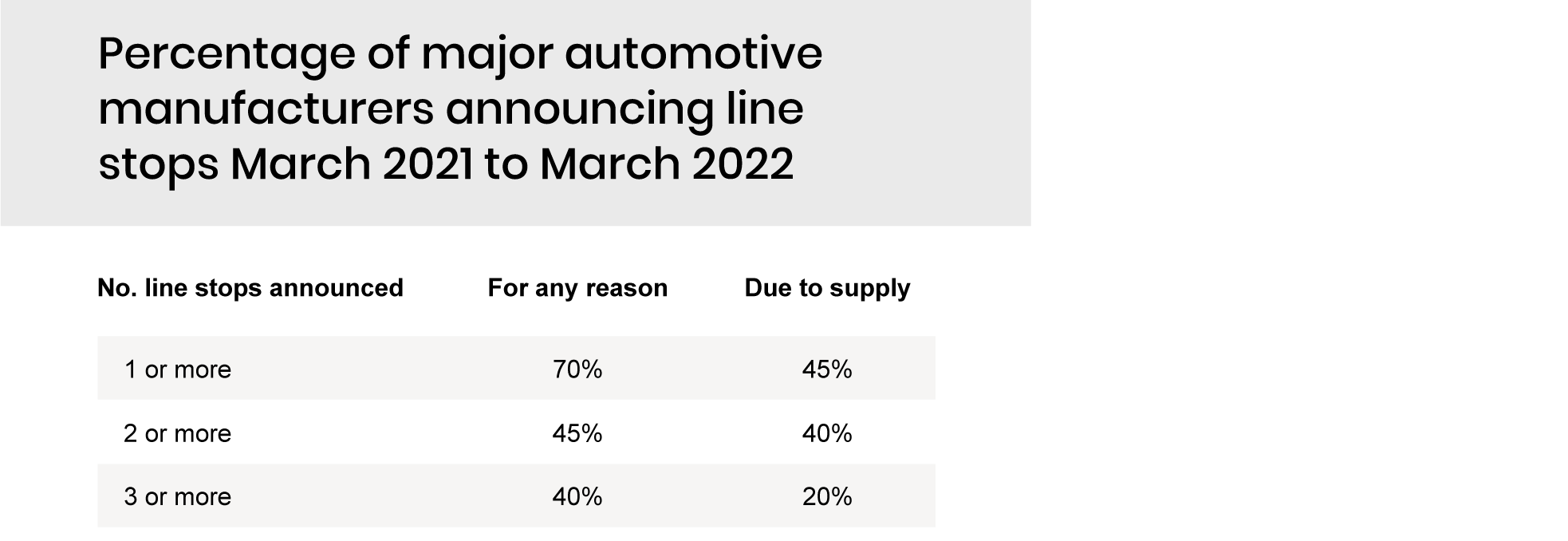

45% of major car manufacturers announced line stoppages in the last year due to supply chain shortages

70% of major car manufacturers announced line stops in the past year, with 45% of them specifically citing supply chain shortages. For those headquartered in Europe and America, it was an even greater proportion, with 60% of the major car manufacturers in those regions announcing factory closures due to supply issues in the last 12 months.

Semiconductor manufacturer stock levels dropped 43% in just over 2 years, reaching the lowest point in a decade

Semiconductor manufacturers’ stock levels reached the lowest point in a decade in Q3 2021, dropping 24% during the pandemic, and 43% from the previous peak in Q2 2019. Some chip manufacturers’ stock fell to just 3 days worth of finished inventory.

![]()

While chip manufacturers’ stock dropped to 23 days, lead times climbed to over 150 days

As demand increased for semiconductors in 2021, supply chain manufacturers were unable to keep up, their inventory levels dropped and lead times rose, which led to automotive line stoppages and left many car manufacturers unable to fulfill their orders.

Taking stock: what does this all mean for manufacturers?

Supply chains have been disrupted by all kinds of challenges in the past two years:

- A factory fire at a major semiconductor plant

- A shortage of shipping containers

- The rise in price of shipping containers

- Factory closures during lockdown

- The Suez canal being blocked

- The Port of Los Angeles becoming backlogged

- And more

Avnet Silica’s Director of EMEA Supply Chain and Operations, Mat Ransom comments:

“While there are signs that semiconductor stocks are being replenished, a full return to normal is unlikely any time soon. It would be convenient to blame the pandemic but the reality is that these changes have been a long time coming.

The continued rollout of 5G, electrification of the vehicle, and demand for data centres amongst other high-growth technologies have all contributed to an increase in demand which is unlikely to be fully met by the increase in semiconductor production in the next few years.

The number of semiconductors in an average car used to be a few hundred, now an electric car can have two or three thousand. And the competition for chips from other industries is also mounting.

Having felt the effects of disruption and the increase in demand so sharply, manufacturers are doing what they can to resolve their current supply chain issues, while simultaneously looking much longer-term to build more resilient supply chains so they’re in a stronger position to adapt to change in future.

Right now, businesses are redesigning their supply chains, moving from ‘just-in-time’ to ‘just-in-case’. In the future, we’ll see some hybrid supply chain models emerge to balance the best of these approaches. While the prevailing focus on lean manufacturing and just-in-time supply chains has worked well to date, a lack of agility and resilience has cost businesses billions in the last 2 years. A new approach is required for the future, and many automotive manufacturers have already started redesigning their supply chains for production in 2026 and beyond.”

Methodology: Data was taken from a mixture of YCharts, with any gaps completed using companies’ financial reports. Due to exchange-rate fluctuations, these figures were not always fully aligned and so checks were made against quarters where both datasets had information and this was used to synchronize the two datasets. In a limited number of cases, for Q4 2021, full figures have yet to be announced. Where this was the case, the company was either not included in our analysis or, where clear trends existed, forecasts were made based on previous quarter figures. These forecasts were then benchmarked against the relevant company’s own forecast and, if the two sets of forecasts didn’t overlap, the midpoint of the company’s forecast was used. Line stoppage data was gathered through a review of company announcements and news headlines, over the past 12 months, for each company.

Sign up for the Avnet Silica Newsletter!

Stay up-to-date with latest news on products, training opportunities and more!

/MYSUPPLY by Avnet Silica

Our supply chain architects get to the heart of your business, exploring your issues up and down the supply chain.

Technical support

Online Support Service

Our European team of expert engineers is dedicated to helping you solve your technical challenges. Get support for a specific product, get technical advice or find alternatives for a specific product.