Funding for European Energy Storage Startups Reaches €2.14 Billion

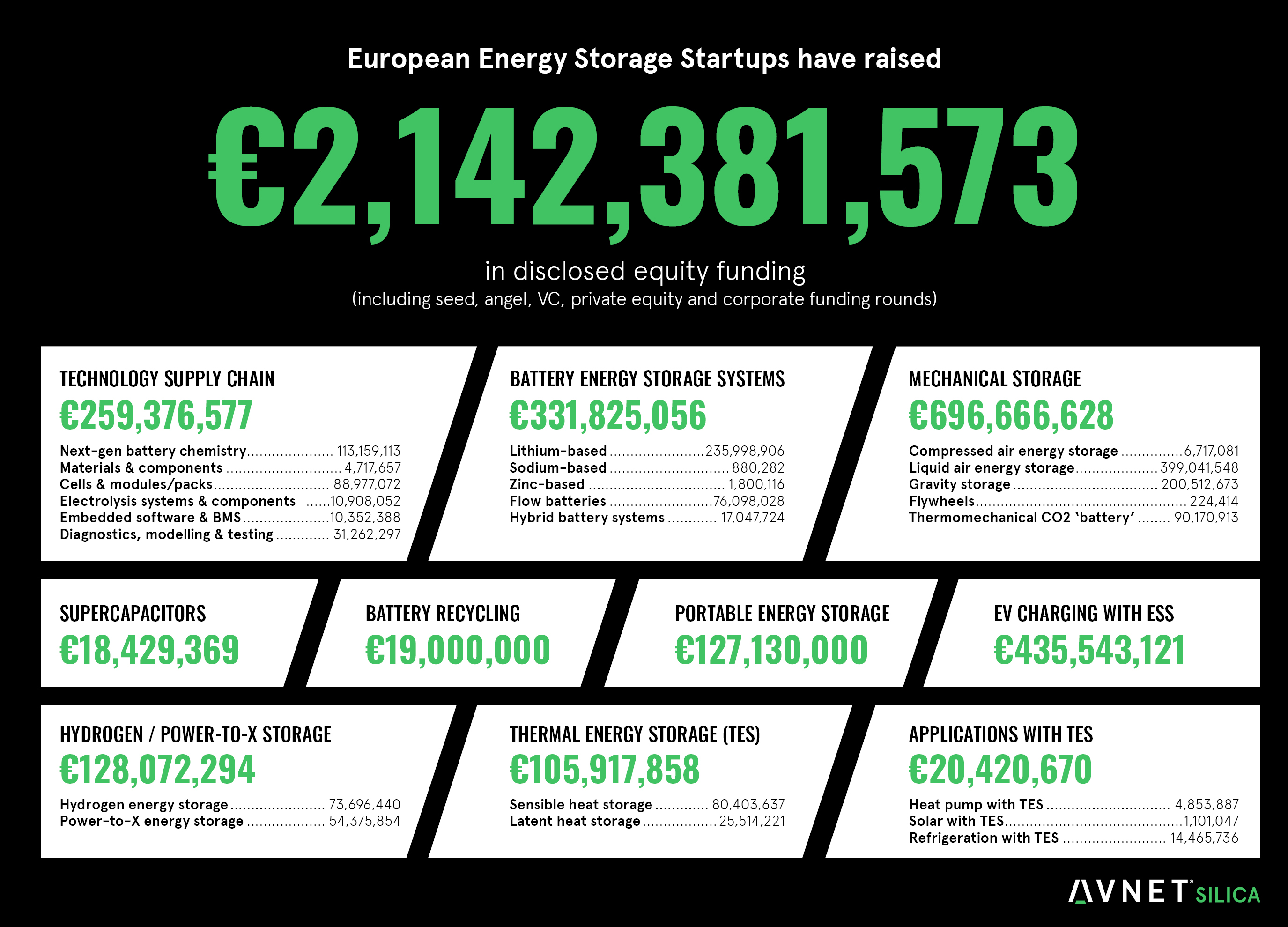

Total equity funding for European startups involved in the manufacturing of energy storage hardware has topped €2.14 billion. 46.7% of the 2.14 billion was raised in the last three years, and 84.4% in the last five, reveals new research from Avnet Silica.

Useful jump links:

- Total cumulative funding for European startups in energy storage

- Breakdown of cumulative funding for European startups in energy storage per technology/market

- Breakdown of cumulative funding for European startups in energy storage supply chain

- Commentary

- Total cumulative disclosed equity funding breakdown

- Data sources and methodology

As storage continues to grow in importance for renewable energy integration, grid resilience and energy security, Avnet Silica analysed Crunchbase data to take a deeper look at the different products European startups are bringing to market, how much funding they’ve raised, and which products are attracting the most investment.

€331.8 million in financial backing for BESS startups

The vast majority of private funding going into BESS is for Lithium-based batteries (€236 million in total), with €221 million allocated to the manufacture of Li-ion batteries and €15 million to lithium-sulfur technology.

Image: Avnet Silica

€76.1 million in equity funding has poured into companies producing Redox flow batteries, with €66.7 million of that going into Iron-based flow batteries – €38.75 million to Germany’s VoltStorage and just under €28 million to Cypriot startup Redox One.

Considerably less disclosed equity has found its way into Vanadium flow batteries despite the technology’s relatively advanced commercial maturity. However, Jersey’s Invinity Energy Systems has raised €18.2 million in grants for its Vanadium flow technology and a further €105.1 million in post-IPO funding.

As for technologies at the seed funding stage, Sweden’s Enerpoly has raised €1.8 million for its Zinc-ion batteries, and Switzerland’s Unbound Potential has received €6.7 million for its membraneless redox flow batteries.

Hybrid batteries also received €17 million in funding, with Spanish startup Hybrid Energy Storage Solutions raising €14.9 million for its Li-ion/ultracapacitor technology. And €2.1m has poured into the aqueous hybrid solution from Finland’s Geyser Batteries.

Mechanical Storage is doing some heavy lifting with €696.7m raised

Mechanical storage has garnered the lion’s share of equity funding in the energy storage market, at €696.7m, more than double that of BESS (€331.8m), despite considerably fewer companies entering the mechanical storage space and fewer still reaching commercial maturity.

The majority of funding for mechanical storage has been allocated to two companies: €339 million to Britain’s Highview Power for its liquid air energy storage, and €200.5 million to Switzerland’s Energy Vault for its gravity storage solution.

Image: Avnet Silica

Founded in 2005 and 2017, respectively, Highview Power and Energy Vault are both now publicly traded, with the latter having raised a further $500 million USD in post-IPO equity – $200 million in 2023 and $300 million in 2025.

Italy’s Energy Dome has also raised €90.2 million in private investments for its thermomechanical ‘CO2 battery’.

Beyond these notable exceptions, other mechanical storage startups have attracted considerably less private funding. Three companies in the compressed air energy storage sector have secured a total of €6.7 million. And three startups constructing flywheels have attracted investment, with two receiving undisclosed amounts and one securing €224,414 to keep the wheels turning.

Emerging Markets & Technologies

At the Pulse of the Market

We're always at the pulse of the market. Explore the trends shaping real innovation: AI, Automotive and ADAS, 5G, Renewables, and more. Act sooner, design smarter, and stay ahead of the curve.

Market Research

BESS startups expand value proposition as competition grows

European startups manufacturing Battery Energy Storage Systems have acquired $331.8 million in equity funding, with 75% of the companies estimated to have reached a phase of commercial maturity, reveals new research from Avnet Silica.

Startup support

Tech/Electronic startup looking for support?

At Avnet Silica, we believe that every great innovation starts with a bold idea and a trusted partner. That’s why we’ve created a dedicated initiative to support electronics startups on their journey from concept to market-ready product.

Thermal energy storage heats up with €105.9 million injection

€105.9 million in private funding is warming up the thermal energy storage (TES) market. €80.4 million has been invested in sensible heat storage, with companies storing heat in a variety of materials, including glass, ceramic, rock, gravel, and salt. A further €24.5 million of investment is helping to transform latent heat storage (phase change materials).

A little over €20 million has been raised by companies focusing on specific applications with in-built thermal storage – €4.9 million for manufacturers of industrial heat pumps with TES, €1.1 million for solar and TES combinations and €14.5 million for refrigeration with TES.

Supercapacitors, hydrogen and power-to-X draw in €146.5 million

Rounding out the range of energy storage providers, €18.4 million has been raised by companies producing supercapacitors, €73.7 million has been invested in companies developing hydrogen energy storage, and a further €54.4 million has been allocated to those offering power-to-x energy storage. This specifically refers to companies promoting hydrogen and power-to-X as a form of energy storage, rather than solely as a means of fuel production.

EV Charging with in-built energy storage secures €435.5 million

Companies offering EV charging with in-built ESS (for off-grid and remote locations or battery-buffered high-power charging) have received €435.5 million in funding.

Three European startups have secured a total of €127.1 million in funding for their portable energy storage solutions, aiming to power the events industry, construction sites, and other use cases.

Quarter of a billion filling up the energy storage supply chain

Over quarter of a billion in funding (€259.4 million) has gone into startups specifically focused on the energy storage supply chain, 78% of which has been funnelled into two particular areas – next gen battery chemistry (€113.2 million), and the production of cells & modules/packs (€89.0 million).

Image: Avnet Silica

Note: While the focus of this study is on companies involved in the production of hardware, it also includes companies specialising in software critical to the manufacturing of energy storage hardware, such as embedded software, BMS, diagnostics, modelling, and testing. It does not, however, include companies that are solely focused on providing software-as-a-service to the end user, such as Energy Management Systems.

Recycling startups raise €19m to bring the process full circle

Bringing the whole process back to the beginning, with a boost for the circular economy, two companies have raised money for battery recycling – Luxembourg’s Circu Li-ion taking in €4.5 million and Germany’s tozero gathering €14.5 million.

This is in addition to the 14 BESS startups promoting the use of second-life batteries in their product line (some exclusively, and others as an available option).

Startups and suppliers rising to the challenge

Reflecting on the findings, Harvey Wilson, Senior Manager Industrial Vertical Markets EMEA at Avnet Silica, comments:

“While there are some well-established players leading the way in energy storage, it’s exciting to see startups offering solutions to the multitude of energy storage challenges that exist within different industries.

There’s the challenge of EV charging in locations that can’t be easily powered by the grid. There’s a need for portable energy in temporary locations, such as events and construction sites. There’s a demand for industrial heat, which largely relies on fossil fuels at present. And beyond battery storage, there’s the issue of long-duration energy storage, the predominant solution for which is currently pumped hydro; however, other options are being developed and offered to the market as well.

It’s also exciting to see startups focusing on the next-generation of materials, components and battery chemistry. The major suppliers of power electronics are also investing heavily in R&D, and we’re seeing lots of innovative technologies coming down the pipeline, enabling the next wave of power products, with higher performance and greater efficiency in energy storage, which will definitely be required if we’re to meet the demands of renewable energy, AI data centres, electrified industries, and our collective climate targets.”

-

Andrew Wu, Business Development Manager at Renesas Electronics, comments:

“Energy storage is evolving rapidly, driven by the need for more resilient grids, deeper renewable integration, and an expanding range of industrial use cases. What stands out in Avnet Silica's research is the pace and breadth of innovation across the ecosystem, from new battery chemistries and long-duration storage concepts to increasingly intelligent management systems that optimise performance in real-world conditions. Addressing these opportunities requires not only innovation, but proven, system-level technologies that can be deployed efficiently and at scale.

Renesas is playing a critical role in enabling this shift through its comprehensive power, analog, and embedded solutions portfolios. As energy storage becomes more deeply embedded across applications ranging from EV charging infrastructure to industrial operations and next-generation computing, the need for tightly integrated, high-performance system architectures continues to grow. Through collaboration with Avnet Silica, Renesas delivers validated winning combinations and complete system solutions that help customers reduce design complexity, accelerate development, and improve overall system efficiency.

The research highlights that innovation is accelerating across the entire energy storage landscape, alongside rapid progress in adjacent technologies such as advanced BMS, high-efficiency PFC, GaN-based power stages, and the rising power demands of AI servers. Renesas’ system-level approach to design and integration, supported by Avnet Silica's expertise, helps translate these advances into scalable, production-ready solutions. Together, this collaboration enables smarter control, higher efficiency, and more adaptable energy storage platforms as the industry continues to scale.”

-

Mark Swinburn, CAS Power & Energy Vertical Manager at NXP, comments:

“The investment clearly underlines confidence in the energy digitalisation journey, providing the necessary support to develop emerging, cutting-edge technologies.

Geopolitics continues to shape investment landscapes, whilst some regions scale back, gaps emerge that create opportunities for those who advance.

As the grid scales up, edge intelligence will become more prevalent, resulting in more efficient, secure, safer, and autonomous systems.

NXP is proud to be part of the innovation, enabling the future through our advanced technology, enablement platforms and support.”

Image: Avnet Silica

Avnet Silica and industry-leading technology partners are shaping the Energy Storage space

Avnet Silica partners with industry-leading technology providers to offer innovative solutions for energy storage system design. Whether you're building residential battery packs, commercial power control systems, or grid-scale storage solutions, our suppliers deliver the performance, efficiency, and scalability of modern energy applications demand.

Head over to our dedicated Energy Management webpage to see how we support energy projects, access useful articles and resources, explore energy management applications, and learn about featured energy management suppliers.

DATA SOURCES & METHODOLOGY

Source: All companies listed under energy storage in the Crunchbase dataset with headquarters in Europe, as at 22nd September 2025.

Further research was conducted by visiting each company’s website, its profile on Crunchbase, its LinkedIn profile, and third-party news articles to provide more granular details on the product and service offerings of each business. This allowed further categorisation of the companies in the list into more specific classifications.

The analysis then focused on startups specialising in the production of energy storage hardware for commercial, industrial and grid-level applications, including companies that focus on the supply chain and manufacturing process specifically within energy storage.

This involved excluding companies that are focused on, for example, energy and commodities trading, project development, software companies, residential energy storage, natural gas storage, nuclear power, and other closely related products and services.

While the analysis excludes companies that are solely focused on providing software (e.g., software as a service), it does include those providing software specific to the manufacturing of energy storage hardware, such as embedded software, BMS, diagnostics, modelling, and testing.

Hydrogen / power-to-x providers are only included where energy storage is explicitly marketed as a use case, and excludes companies entirely focused on hydrogen / power-to-x as fuel production.

Disclosed equity funding includes seed, angel, VC, private equity and corporate funding rounds. It does not include equity crowdfunding. It also excludes grants, debt financing, IPO and post-IPO funding.